As an entrepreneur, staying on top of your business transactions may feel like a never-ending task. Receipts, invoices, and contracts – together, they contribute to the intricate web of bookkeeping that gives you a clear picture of your business finances. Yet, with the demands of running your business or constantly being on the move, maintaining an organized system for these records can be a challenging task. This is where a dedicated and reliable system for storing and tracking your paperwork comes into play.

What is the point?

Keeping your business’ financial records in check not only saves you from future headaches but also fulfills a legal requirement. The benefits of maintaining well-organized business receipts and financial documents offers benefits that go beyond mere compliance. They are essential for:

- Avoiding penalties from regulatory bodies like the CRA (Canada Revenue Agency) for the lack of proper supporting documents.

- Filing accurate end-of-year tax returns.

- Improving internal controls on spending and expense approval.

- Navigating any future auditing processes smoothly.

The CRA mandates that businesses retain all records and supporting documents for six years after the last tax year they pertain to. Embracing the habit of collecting and organizing receipts for every transaction, no matter how small, pays massive dividends as soon as you are required to show evidence of a transaction that happened months or even years ago.

Choosing the Right Receipt Management Approach

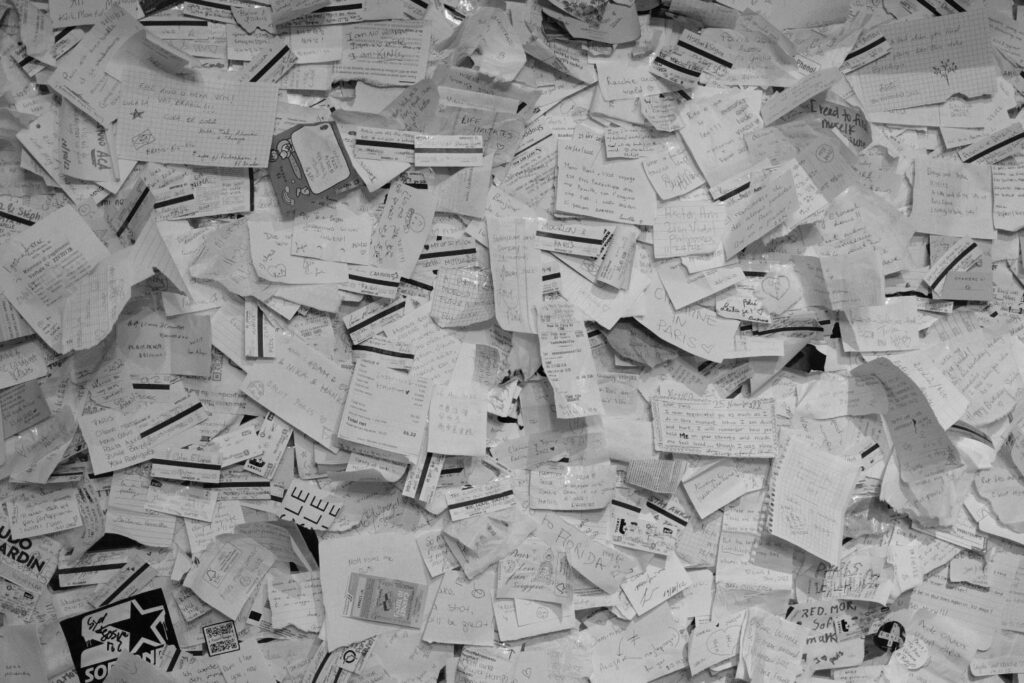

When it comes to organizing receipts, there are two primary options – physical filing and electronic management.

Physical Receipt Storage

For those naturally inclined towards meticulous organization, storing paper receipts might seem appealing. However, maintaining this method requires consistency and diligence. Without a dedicated process and management, physical storage can become disorganized, inefficient and difficult to navigate. There are also significant risks associated with only keeping physical documents for your business. Unless backups are stored at a separate location, physical storage will always be vulnerable to theft, fire, and natural disasters.

Electronic Receipt Storage

Physical storage has its merits. However, electronic storage has progressed to be a far more beneficial method of keeping your business documents organized and accessible. Some of the benefits include:

- Schedule backups to ensure the safety of your documents.

- No physical space is needed to keep years of records.

- Customize permissions to restrict individual access to authorized documents.

- Immediate upload of documents, making them accessible to relevant people and systems.

- Finding documents is simple when you can sort or search for documents by keywords such as vendor, amount, date, or account.

- Directly link electronic documents to accounting transactions as a backup for users or auditors.

- Remote access allows you to complete work without needing to be in the office.

On top of the benefits of using electronic storage, developers are constantly creating software to make your part of the process easier. Tools like Dext Prepare simplify receipt management. You can photograph receipts with your phone and upload them directly to an app. The software extracts critical data like dates, vendors, and amounts, and integrates seamlessly with your cloud accounting software, such as Quickbooks Online, to link electronic backup to your accounting transactions and allow your bookkeeper to keep everything up-to-date.